What do savings

with Modra provide?

SAFETY

Modra zavarovalnica is one of the most capital-strong pension fund managers. Your savings are safe as the business is closely supervised by the Insurance Supervision Agency, while the Securities Market Agency and the custodian bank monitor the performance of the funds on a monthly basis.

INHERITANCE

All savings are your property and are inherited in the event of your death. You can designate beneficiaries in the event of your death at the time of enrolment or at any time afterwards. If no beneficiaries are designated, the funds are inherited by your legal heirs.

LIFETIME ANNUITY

After retirement, it is time to draw your savings in the form of an annuity. An annuity is regular income that you receive for the rest of your life on top of your basic pension. You choose the type of annuity according to your financial needs.

TAILORED SAVINGS

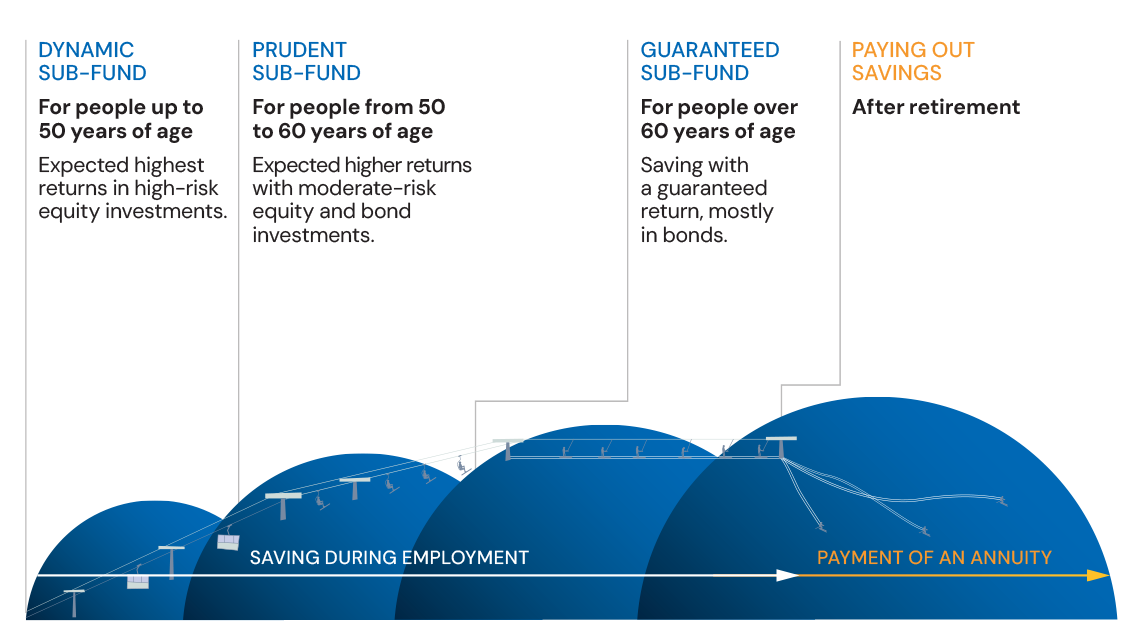

The Life-Cycle Fund consists of three sub-funds: dynamic, prudent, and guaranteed. They pursue various investment policies that adapt to the savers age and allow savers to automatically switch between them. You can also choose your own sub-fund, taking into account the age limit.

)

)

)

)

As the saver ages, savings move through different sub-funds to achieve optimal returns over the long term.

As the saver ages, savings move through different sub-funds to achieve optimal returns over the long term.

080 23 45

080 23 45 info@modra.si

info@modra.si Digitalna poslovalnica

Digitalna poslovalnica